The National Life Group of insurance companies offers several programs depending on your needs. If you are looking for simple term life insurance coverage, not only can they offer it, they offer programs that come with living benefits. You can get more information here.

National-Life-Group-Term-Life-Products-Link

For companies who want to offer an amazing employee benefit for their most important employees, and for individuals who need a substantial amount of life insurance but do not want to liquidate assets in order to obtain coverage, we work with National Life Group and NIW to offer a very special premium finance program. Call us to get more information but some highlights are listed below:

Financing Large Life Insurance Premiums

You need a substantial amount of life insurance but do not want to liquidate assets in order to obtain coverage.

Premium financing offers an alternative way to pay for life insurance premiums.

This strategy may offer the following:

- Obtain needed amount of life insurance

- Provide an alternative method for premium payments

- Can help maximize gift and estate tax planning strategies

When Your Goal is to Maintain Your Current Financial Strategy and Pass Your Financial Legacy to Future Generations

How it works:

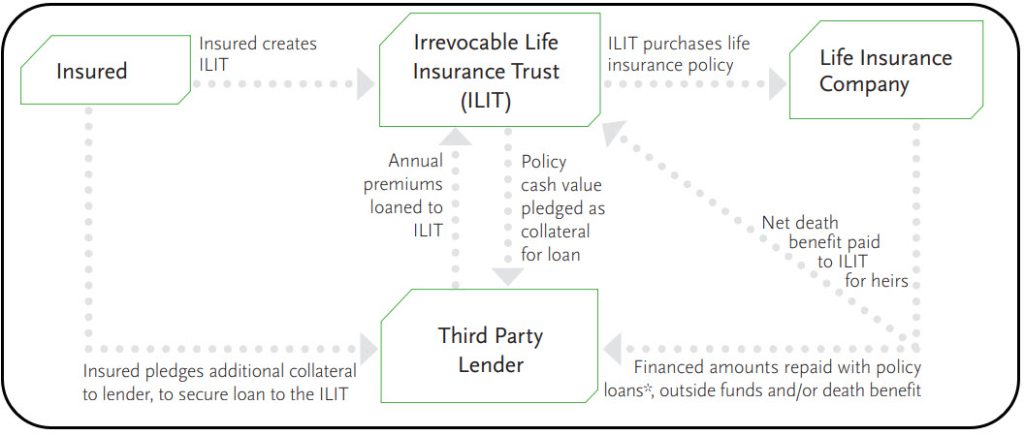

- Your attorney drafts an irrevocable life insurance trust (ILIT).

- The ILIT purchases a policy on your life.

- A third-party lender loans funds to the trust each year to pay the premiums on the policy.

- You may choose to finance all of the premium, a portion of the premium, or the premiums plus accrued interest and other costs.

- The cash value of the policy, plus other outside assets, are pledged as collateral for the loan. Acceptable forms of collateral may include cash and cash equivalents, marketable securities and letters of credit.

- A lifetime exit strategy from the arrangement should be explored and can be accomplished through a combination of policy loans and other resources (for example, the proceeds from the sale of a business or real estate, an inheritance, etc.).

- At your death, any unpaid loan and loan interest is paid back to the lender.

- The remaining death benefit is paid to your ILIT for the benefit of your beneficiaries.

You should also be aware of some disadvantages and risks involved:

- Changes in interest rates can put premium finance structures and your collateral at risk.

- Policies may not perform as expected.

- There may be additional collateral requirements, the possibility of loan default which may cause you to lose your collateral and a reduction of the net death benefit to your beneficiaries resulting in insufficient resources to satisfy estate liquidity or family needs.

- The lender may not renew the loan after its original term and new financial underwriting may be required. Collateral may be lost if a new loan cannot be obtained.

The premium finance concept is simple, but the transaction is complex – it is important to involve your tax and legal advisors in the process. Careful consideration should be made to determine if this concept is suitable for you in light of your risk tolerance and circumstances.

Notes:

Products issued by National Life Insurance Company® | Life Insurance Company of the Southwest™ – This example is shown purely for discussion purposes and your potential implementation of Premium Finance may differ. Underwriting limitations and company guidelines may restrict your ability to participate in premium financing. * Policy loans will reduce the policy’s cash value and death benefit and may result in a taxable event. Policy loans are not guaranteed and may be insufficient to fully pay off third party loans. National Life Group® is a trade name of National Life Insurance Company, Montpelier, VT, Life Insurance Company of the Southwest (LSW), Addison, TX and their affiliates. Each company of National Life Group is solely responsible for its own financial condition and contractual obligations. LSW is not an authorized insurer in New York and does not conduct insurance business in New York.

This business strategy is offered and managed by an independent third party who is not affiliated with companies of National Life Group. No National Life Group company nor anyone acting on its behalf has evaluated the strategy or is authorized to make any representation regarding the suitability, effectiveness, legality or the suitability of using life insurance or annuities in connection with the strategies described here. This is not a solicitation of any product or service. National Life Insurance Company and Life Insurance Company of the Southwest are bound only by the terms of the life insurance contracts they issue. The premium finance company is not responsible for the guarantees of the issuing company.

Centralized Mailing Address: One National Life Drive, Montpelier, VT 05604 | 800-732-8939 | www.NationalLifeGroup.com

National Life Group® is a trade name of National Life Insurance Company, Montpelier, VT, Life Insurance Company of the Southwest, Addison, TX and their affiliates. Each company of National Life Group is solely responsible for its own financial condition and contractual obligations. Life Insurance Company of the Southwest is not an authorized insurer in New York and does not conduct insurance business in New York.

Source of this information is NLG Brochure 64166(1012)PremiumFinancing.indd retrieved from here on 6/29/2022.